HAMILTON TOWNSHIP, Ohio — Lawmakers hope a newly proposed piece of legislation will keep money in Ohioians' pockets.

State Rep. Adam Mathews (R-Lebanon) co-sponsored a piece of legislation to eliminate the state income tax and commercial activity tax.

“The goal for eliminating Ohio’s income tax is to show that we are business and family-friendly,” Mathews said. “Allowing people to keep more of their money in their wallets, in their budgets and allow the government to high-size itself to increase and involve and engage more businesses to come here and to grow here.”

Mathews said the plan would be modeled after Texas and South Dakota, and could get rid of the taxes by 2030.

“We are modeling every two years what the type of revenue should be, what the type of spending should be, and if we’re not hitting those numbers then we re-evaluate,” Mathews said.

A similar bill was also introduced in the Senate.

“We need to bring control back to the state,” said Hamilton Township resident Paul Sisk.

Sisk was one of the people who attended Mathews' town hall Tuesday night to learn more about the proposal.

“What happens if we don’t have income tax revenue like we have today? Where are we going to make up for that,” Sisk said.

Mathews estimated the income tax budget deficit would be $8 billion.

Tax policy researcher Bailey Williams with Policy Matters Ohio said that deficit is closer to $10.5 billion. He said combined with the commercial activity tax, the state will face a $13 billion budget deficit.

“This is a terrible policy idea,” he said. “It really will be a tax cut that will benefit the wealthiest Ohioans.”

He said Ohio has been slashing the state income tax for 20 years.

“We had rates that were as high as 7.5%. Now, the highest tax bracket is 3.75%. We haven’t seen large economic activity or large economic growth coming from those tax cuts,” he said.

Williams said if this legislation passes, he expects other taxes to go up.

“The sales tax is the one area where we’ll most likely see an increase,” Williams said. “We cannot assume there’s going to be great economic stimulation from these tax cuts.”

Mathews said the tax breaks would bring more businesses, jobs and people to Ohio. He believes eliminating these taxes would give Ohio an advantage over neighboring states. He said it could also keep retirees from leaving.

“Where would I retire? And I’ve thought about going to a state where there’s no income tax,” Sisk said. “I like Ohio and I want to stay here, so if we can avoid paying an income tax then that sounds really exciting for me.”

Mathews said one way they could help balance the budget is by digging deep.

“We do want to unleash natural gas to be able to help fund our move away from the income tax as well as making sure the state does not continue to grow,” he said. “I think we can keep government from growing and expanding to however much taxpayer dollars we want to feed it, and instead restrain ourselves, limit government and follow the other models of other states like Florida.”

Williams said that likely won’t work.

“While we have natural gas on some level we do not have that natural gas production on the level of oil production in Alaska. We do not have the tourism levels that Florida has,” Williams said.

He said he also worries about what could happen if the country goes into a recession, and Ohio has no state income tax. He said the result could be huge state budget cuts.

The bill was introduced in January and is currently in House committee. He anticipates the committee taking it up in the spring with a possible vote in the fall.

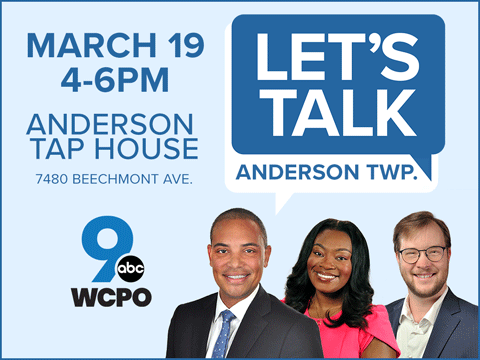

Here’s a schedule for Mathews's upcoming town halls: