Paying for college is one of the biggest financial challenges many families face. And according to a new roadmap from T. Rowe Price, the numbers are eye-opening:

You’ll need around $105,000 per child by age 18—and that only covers about half of in-state tuition.

Here’s what they suggest:

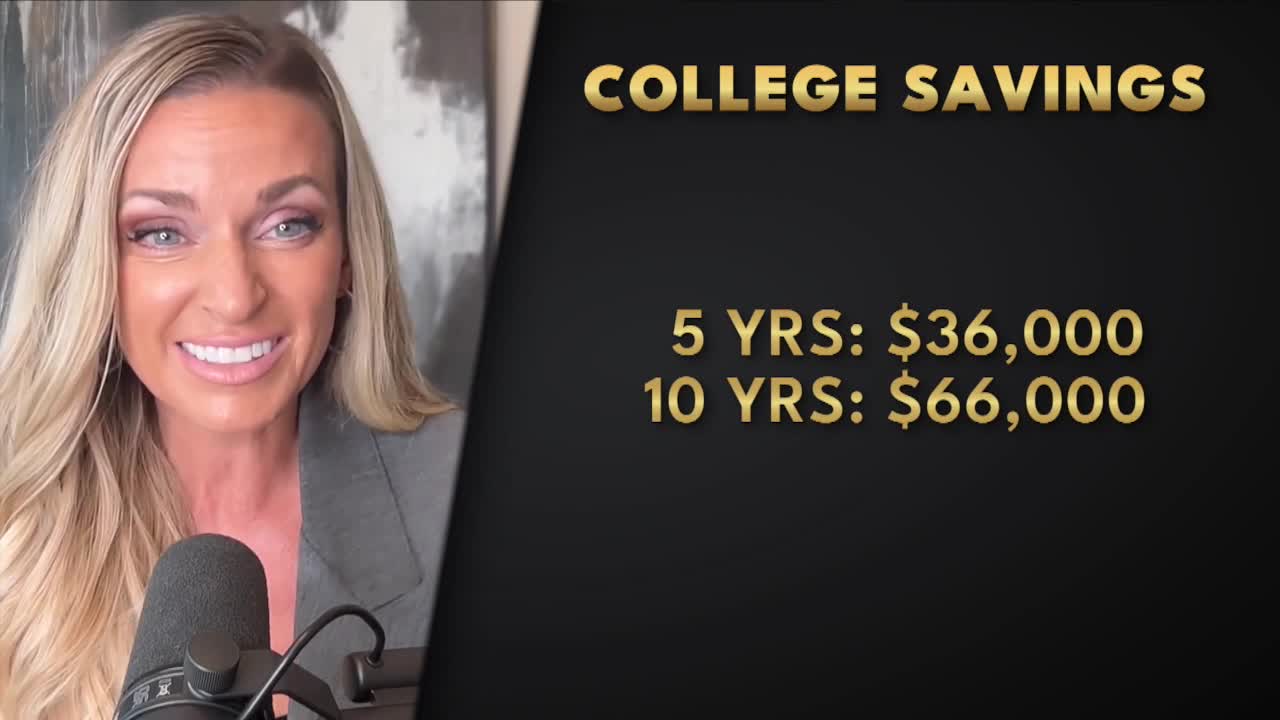

🎓 By age 5 — $36,000

🎓 By age 10 — $66,000

🎓 By age 13 — $81,000

It sounds overwhelming, but there are practical ways to prepare.

1. Start Early with a 529 Plan

You can open a 529 savings account before your baby is even born. Start it in your name, and once your child arrives, update the beneficiary. The money grows tax-free—so every dollar goes further.

2. Set Expectations Now

Be honest with your kids about what you can help with and what they may need to handle themselves. These early conversations help avoid stress later.

And here’s the most important part:

Don’t sacrifice your future to fund theirs.

I’ve seen parents drain savings or delay retirement—not because they had to, but because they felt like they should. Helping with college is admirable—but not at the cost of your own stability.

Your kids can apply for scholarships. They can take out loans.

But you can’t borrow to fund your retirement.

A smart next step?

Use a free online debt or savings calculator to map out what’s realistic for your family and future. Knowing where you stand helps you build a plan you can actually stick to.

Because the best way to support your kids is by staying financially strong yourself.

For more practical money advice, tune in to Your Money Minute with Candy Valentino every Thursday at 10am on WCPO 9.

DISCLAIMER: Your Money Minute is furnished by Bandit Productions