Gut-wrenching.

That’s how pharmacist Craig Seither described the feeling of closing the Fort Thomas Drug Center last summer – a community staple for nearly 75 years.

Seither, a career pharmacist and lifelong resident of Fort Thomas, owned and operated Fort Thomas Drug Center since 2007. After 16 years, though, Seither’s business was facing economic headwinds.

Caught between a rock and a hard place, he had a decision to make: continue operating at a loss or shut down completely. It was something he had stewed over for months, Seither told LINK nky.

“I think it was a decision where I didn’t see any other option,” he said.

Ultimately, Seither closed the Fort Thomas Drug Center at the end of the business day on June 18. He somberly taped three notes to the doors explaining the rationale behind the decision. As he walked away for the final time, a significant chapter of his life had come to an abrupt close. He lost his business; Fort Thomas lost an institution.

“There was a lot of pride in having an independent pharmacy,” Seither said. “It was something out of Norman Rockwell.”

The news of his closing sent shockwaves through the community. Former customers posted heartfelt messages to the business’s Facebook wall. Some offered condolences and shared memories while others searched for an explanation.

Last year, two other independently owned pharmacies in Northern Kentucky unexpectedly shuttered: Ludlow Drugs and Alexandria Drugs – both serving communities of less than 10,000 people.

Two months after Seither closed in Fort Thomas, Katie Litmer, owner and head pharmacist at Ludlow Pharmacy, decided to close her business under similar circumstances. She described the decision as the most difficult she’d ever made. Ludlow Pharmacy served the small community for 42 years. Litmer took over the reins from her father, Jim, in 2012 and successfully served the residents of the small Kenton County river city for 12 years.

“I had grown up in this pharmacy working alongside and learning from my dad, Jim, for many years before transitioning to owning the pharmacy. I’ve had the privilege of knowing and caring for many of you for most of my life, which is why I’m sad we’re closing for reasons beyond our control,” Litmer wrote on Sept. 28 – the day Ludlow Pharmacy officially closed.

Like Seither, Litmer said her last day on the job was filled with emotion, going so far as to say she “dreaded” it. She filled the last of her customers’ prescriptions while juggling multiple media inquiries and the emotional weight of closing her family business. After closing, Litmer was greeted with an outpouring of support from the community.

“We’ve been involved in the community for our entire lives essentially,” Litmer told LINK nky. “It just got to the point where it wasn’t sustainable. Because of our ties to the community and our long history, I hung on a little longer than maybe I would’ve if I didn’t have an emotional attachment to the community.”

Although Litmer said the last day went as well as she had hoped, she was still frustrated, telling LINK nky that she felt the decision was almost beyond her control.

Walgreens, the largest brick-and-mortar pharmacy chain in the world, was the primary beneficiary of both pharmacies’ closing. All of Fort Thomas Drug Center’s prescription files were transferred to the Walgreens at 1601 Monmouth Road in Newport, while Ludlow Pharmacy’s were transferred to the Walgreens at 1825 Dixie Highway in Fort Wright.

“I would’ve never thought that I would’ve sold to Walgreens in a million years,” Litmer said. “That wasn’t even on my radar, but unfortunately it got to that point.”

Since the closures, neither Fort Thomas nor Ludlow residents have access to a pharmacy within city limits.

“Communities lose easy access to their trusted health care partner,” Litmer said. “It’s really frustrating to see.”

Why did Seither and Litmer decide to close their businesses? They both pointed the finger at one primary entity: pharmacy benefit managers.

PBMs are third-party companies that act as middlemen between pharmacies, health insurance providers and pharmaceutical manufacturers. According to a market research report published by Fortune Business Insights, the PBM industry is currently dominated by three corporations: Express Scripts, CVS Caremark and Optum Rx. These corporations hold around 80% of the over $500 million market.

Alexandria Drugs owner Amy Glaser told LINK nky in December that financial pressures from PBMs were one of the main factors in her decision to close.

Independent pharmacies are becoming an endangered species across Kentucky. In 2023 alone, 67 independently owned pharmacies closed in the state, many in rural and low-income communities.

“I’m very saddened by it, but it’s really when you start looking at rural communities,” Seither said. “They say pharmacies are the most readily accessible health care providers, so now you have a situation where it might be 40 to 50 miles to the next closest pharmacy.”

These pharmacies provided critical access to medicines for many residents in need while also serving as landmarks within their small-town communities. Many of these businesses, like Fort Thomas Drug and Ludlow Pharmacy, were family-owned and operated for decades.

From Seither and Litmer’s perspective, the implementation of direct and indirect remuneration fees by PBMs, as well as other drug pricing and reimbursement tactics, caused independently owned pharmacies to take losses when filling prescriptions. As those losses accumulated, it became almost impossible for proprietors to turn a profit and sustain a viable business.

That situation, coupled with increased competition from large pharmacy chains such as Walgreens, forced dozens of independent pharmacies in Kentucky to close and left others on shaky economic ground. If the trend continues, more independent pharmacies could close, leaving some communities and their residents without reliable access to necessary medications.

“If 67 independent pharmacies close in Kentucky, what’s the magic number before it reaches a true access issue where communities say, ‘Hey, we don’t have a pharmacy within a 100-mile radius’?” Seither asked.

In the months before closing Fort Thomas Drug Center, Seither participated in an online crusade against PBMs on his business’s Facebook page, chiding the corporations for the fees he said were negatively affecting his business’s cash flow. After closing his business, he continued to advocate for independently owned pharmacies on social media.

Litmer has done the same, posting messages in support of independent pharmacies on her social media while calling out PBMs.

‘Take it or leave it’

The problem for all pharmacies, not just independent ones, is that many have to do business with PBMs because of their integral role in the U.S. pharmaceutical sector by managing prescription drug benefits for health insurance plans, including Medicare Part D. While not explicitly required to contract with PBMs, many pharmacies do so because of the access to patients served by these insurance plans.

PBMs negotiate contracts with pharmacies to establish reimbursement rates and terms for dispensing medications to patients covered by PBM-affiliated insurance plans. Pharmacies have the option not to contract with PBMs if they don’t find the terms favorable, but choosing this route could limit their customer pool, especially ones with insurance plans managed by PBMs.

“There might be some fairer contracts within the insurance’s book of business, but there’s also some really lousy ones, and that’s the conflict,” Seither said.

Because of their size, larger pharmacy chains like Walgreens have more negotiating clout than smaller, independently owned pharmacies that lack capital and resources.

To combat this, many independent pharmacies join pharmacy services administrative organizations – collectives of independent pharmacies – to negotiate on their behalf. Despite this, Seither said not all contracts are created equal, even when they’re being negotiated by a PSAO. For Seither, the contracts always seemed like a “take it or leave it” proposition.

“For independent pharmacies, they will have one contract, and that contract is called ‘take it or leave it,’” Seither said. “There’s no negotiating. It’s basically, ‘Here’s our contract – if you want to be a part of this, then these are the terms.’”

The DIR death knell

Under Medicare Part D, PBMs impose direct remuneration fees on pharmacies as part of their contract. DIRs can include administrative costs, network access costs, and other charges corresponding to pharmacy performance metrics. DIRs are generally outlined in the contracts between PBMs and pharmacies.

Proponents of DIR fees describe them as a form of value-based contracting in Medicare Part D that incentivizes pharmacies to provide quality care while helping to keep beneficiaries’ cost-sharing and premiums affordable.

Critics lambasted the fees’ opacity and complexity. The National Association of Chain Drug Stores calls the quality measures “unpredictable, inconsistent, and outside of a pharmacy’s control.”

Indirect remuneration fees are levied by PBMs and recouped after the point of sale. These fees are based on the difference between the amount a pharmacy is reimbursed by the PBM when the drug is dispensed and subsequent retroactive reimbursement adjustments for potential changes in drug pricing or network contracts. Indirect remuneration fees can be “clawed back” anywhere from a few weeks to several months after a prescription is sold.

The Centers for Medicare and Medicaid Services, the governing apparatus for DIR fees, found that retroactive DIR fees increased a jaw-dropping 107,400% between 2010 and 2020. Moreover, an increasing number of employer-provided plans are being reimbursed for less than half of the drug’s purchase price, causing pharmacies to lose money on the sale.

“An alarming number of commercial claims are being reimbursed at less than the drug itself costs the pharmacy to buy it, before even accounting for the cost of the bag, the vial and the time of the professional trained to dispense the prescription,” Litmer said.

According to documents provided by Seither, Fort Thomas Drug lost $7,025 on nearly 700 prescriptions the business filed in June 2023. Litmer cited a similar pattern in her closing letter, detailing how filling a prescription for a brand-name heart medication left the business nearly $20 in the hole after DIR fees were extracted.

This practice could hit some pharmacies harder than others, depending on the makeup of their customer base. Some pharmacies might provide more prescriptions for customers covered by Medicare, while others might deal with more employer-provided plans. For Ludlow Pharmacy, both sounded death knells.

“We were unable to survive with the reimbursements provided for the mix of business we were currently able to access,” Litmer said.

Legislative help

Caught in a fight-or-flight situation, many independent pharmacy owners have lobbied Frankfort and Washington, D.C., to curb the impact of DIRs.

“Basically, if you don’t get involved in politics, you won’t be involved in pharmacy,” Litmer said.

In September, Rosemary Smith, cofounder of the Kentucky Independent Pharmacist Alliance and owner of Jordan Drug, a pharmacy chain serving rural eastern Kentucky communities, wrote a letter to U.S. Rep. James Comer, of Kentucky’s 1st Congressional District, describing PBMs as a “python slowly choking the life out of independent pharmacies.”

“DIR fees were originally intended to incentivize pharmacies to provide high-quality care but quickly evolved into an enormous source of revenue for the big three PBMs who control 85% of the prescription market,” she wrote.

“PBMs claim they are taking back money months after prescriptions are filled due to a pharmacy’s performance or so-called quality measures,” she continued. “In fact, nothing any pharmacy does has been shown to tie back to the vast amounts being clawed back.”

In 2020, Kentucky passed a law sponsored by state Sen. Max Wise (R-Campbellsville) that eliminated six PBMs from managing the state’s Medicaid prescription drug business, instead limiting management to one PBM. Medicaid is Kentucky’s largest health plan and a major source of income for health providers like hospitals, doctors and pharmacies. Seither said this legislation alone is estimated to have saved the state nearly $300 million between 2021 and 2022.

Four years later, Kentucky is on the verge of passing Senate Bill 188, which would diminish PBMs’ role within the state’s private health insurance industry. Once again, Wise sponsored the bill.

Some of the bill’s key provisions include prohibiting PBMs from mandating mail-order prescriptions, ensuring fair reimbursement rates for community pharmacies, preventing PBMs from steering patients toward pharmacies owned by them – such as CVS Caremark – allowing independently owned pharmacies to fill 90-day prescriptions for maintenance drugs, prohibiting higher co-pays at independently owned pharmacies compared to PBM-owned pharmacies and protecting independently owned pharmacies from retaliation for providing cost-saving information to patients.

“I’m optimistic this measure will yield similar savings by applying the same standards to the commercial market, effectively cutting costs for Kentuckians with private health insurance plans,” Wise said in a press release.

On March 26, the bill passed the state Senate on a 35-1 vote. Two days later, the state House of Representatives passed the bill with a resounding 97-0 vote. The bill now sits on Gov. Andy Beshear’s desk awaiting a signature.

Tennessee, Ohio and West Virginia have all passed legislation to curb PBMs’ oversized influence on their states’ health care system.

In the meantime, many Kentucky pharmacies are still struggling with day-to-day operational costs, and their futures are uncertain.

Customers choose these businesses because of the familiarity and the personal care their pharmacists provide. Shopping at a locally owned pharmacy also is a way for people to support their community. Without these businesses, the city loses a part of its identity, Seither said.

“You have winners and losers, but I think the losers are increasing significantly,” Seither said. “Consequently, you don’t have a Fort Thomas Drug Center, Alexandria Drug or Ludlow Pharmacy anymore.”

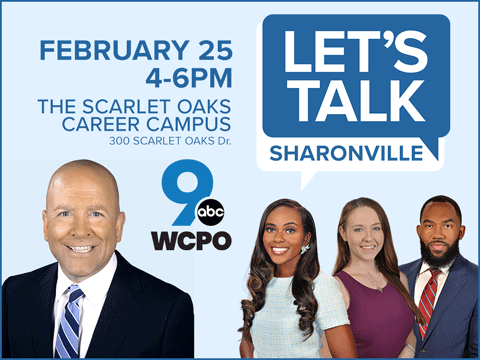

LINK nky is a media partner of WCPO.com.