Correction: Original story had inaccurate numbers for P&G's outstanding shares.

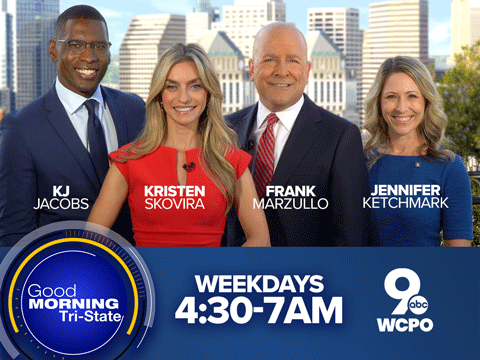

CINCINNATI - What would Cincinnati be like if Tide and Pampers left town? That’s what activist investor Nelson Peltz asked Procter & Gamble’s CEO to consider at their first meeting, David Taylor told WCPO Thursday his first local TV interview.

“He said, ‘David, you need to give your businesses more autonomy. I’d move your businesses out of headquarters,’” Taylor said. “I said, ‘Nelson, you realize what you're saying? Why would that make sense?'”

Six months later, Peltz and Taylor are locked in a titanic struggle over the future of Cincinnati’s most important company. With 10,000 local employees and roughly $9 billion in local shareholder wealth tied to the consumer products giant, P&G leaders are pulling out all stops to keep the New York hedge fund manager off its board.

P&G has told shareholders it will spend $35 million to oppose Peltz in what experts have called the most expensive proxy contest in U.S. history. Peltz’s Trian Fund Management LP says it will spend about $25 million to win shareholder support.

WATCH the full interview in the player below.

Up to 2.6 billion shares are expected to cast a vote by the time P&G’s annual meeting takes place in October. But apart from criticizing P&G as a slow growth company that’s losing market share and is burdened by bureaucracy, Peltz has yet to say publicly how exactly he would fix P&G.

But Taylor said Peltz told him privately in February that P&G should consider a holding company structure to put more decision-making authority in the hands of executives that lead the company’s 10 major business segments. Taylor said that could be a first step toward a breakup of P&G, something Peltz has advocated at other companies but has pledged not to do at P&G.

“Certainly it would mean less jobs in Cincinnati,” Taylor said. “The real issue is, it’s not good for the company. It’s not good for results. It’s not good for shareowners. It’s not good for Cincinnati. So it’s not something that I think makes sense to do.”

RELATED: Editorial: P&G shareholders should reject Wall Street's advances

Trian Fund Management did not respond to WCPO's request for a reaction to Taylor's comments.

P&G has spent the last five years reorganizing the company into 10 product categories with 65 brands that have the best potential for reliable growth. Those categories include Baby products led by Pampers and Fabric, which includes Tide, Gain and Downy. But P&G sold about 100 brands, exiting the beauty and food business entirely. It also eliminated more than 30,000 jobs so it could re-invest the cost savings into those 65 remaining brands.

Taylor said P&G gains operating efficiencies from housing research and development, sales and marketing functions in Cincinnati. So, relocating all business units out of Cincinnati would cost the company more in the long run. He also said six product categories are already based outside of Cincinnati, but three of its best-performing business units are based here.

“You’d lose a lot of your leadership” by following Peltz’s advice, Taylor said. “This is our home. It’s been our home for 180 years. Why would we do that? It’s not good business. We’d lose people and we care about the community.”

Cincinnati will play a pivotal role in the proxy contest because P&G has an unusually high number of retail shareholders, or individual investors who own small blocks of shares in their retirement plans or stock accounts. Out of P&G’s roughly 2.6 billion shares outstanding, spokesman Damon Jones said these small investors own about 40 percent, or roughly 1 billion shares. Of that group, local retirees, employees and their heirs own about 10 percent, or $9 billion worth of stock.

That’s why Taylor is now emphasizing the potential impact to Cincinnati of letting Peltz join P&G’s board.

“I look at past behavior as an indication of what one may consider in the future,” he said. “Nelson Peltz and Trian have been involved many times in other companies where they have advocated breakups … He has not said that for this specific example, but the idea of moving businesses out of headquarters and the idea of a holding company structure certainly could cause one to question that.”

Taylor called attention to language in Trian’s proxy documents which assert that he has “no duty to update” shareholders on his activities after the contest is over.

“It’s like a politician,” Taylor said. “You can say anything up ‘til the election (but) the best indication is what one has done in the past.”

Taylor repeated earlier claims that Peltz is basing his business advice on outdated information provided by former Chief Financial Officer Clayton Daley, who left P&G in 2009. He also revealed that four former Procter & Gamble CEOs have endorsed the company’s current strategy, which means A.G. Lafley, Bob McDonald and John Pepper will likely soon ask shareholders to vote against Peltz.