LEBANON, Ohio — The City of Lebanon underpaid two local school districts $3.1 million in property taxes collected through taxing districts established to help pay for roads and other improvements in the city’s industrial parks, according to a press release issued Friday by the city.

Over 20 years, the city underpaid both the Lebanon City Schools and Kings Local Schools more than $1.5 million, according to the release.

“The city is taking steps to distribute this money to each school district,” according to the release.

“City staff identified potential discrepancies in how Tax Increment Financing (TIF) payments have been distributed to two local school districts, and initiated an extensive independent third-party review of the TIF program to ensure that the payments were allocated properly,” according to the release.

Businesses are to make the payments in lieu of property taxes to the city, according to the Journal-News. It was unclear which businesses were involved.

“The underpayments were largely the result of changing tax values over this period, as well as different rates and charges impacting property tax payments,” the release said.

Warren County Auditor Matt Nolan said, “This is an ongoing problem around the state.”

In this case, Nolan, whose office collects property tax in Warren County, said he was unable to confirm the information released.

“The school district and local entities work out agreements and often do not include the county in them at all. We have no way of knowing what is owed on TIFs and no way of enforcing the agreements if we do,” Nolan said in an email response to questions.

In response to questions, Lebanon City Manager Scott Brunka said, “I think it is important to note that the TIF payments being made to the city were deposited in the separate TIF fund, which has the cash reserves necessary to make the payments to each school district that are necessary to ensure compliance with the terms of the agreement. This will not impact general city services in any manner.”

Brunka said the city manages 37 tax incremental financing district agreements. He said an informal review of “several” of the agreements prompted the larger audit.

The city press release included statements from both school districts.

Lebanon Superintendent Todd Yohey said: “On behalf of the Lebanon City School District, I want to thank our city leaders for performing this audit on their approved TIF agreements over the past 20 years. It is not often that a school district receives back-payment for such findings, and these funds will certainly help our school district offset some costs. However, these funds will not replace the need for new operating revenue to maintain our quality of education and community residents should expect to see an operating levy on the ballot sometime in 2019.”

Superintendent Tim Ackerman and Cary Furniss, Treasurer and Chief Financial Officer for the Kings Local School District, provided the following statement, “The Kings Local School District appreciates the leadership of the officials at the city of Lebanon for taking the initiative to audit the compensation agreements for the TIF properties with our district.

“The challenges of applying Ohio school finance to these agreements is difficult and the commitment to getting it right is to be commended. The one-time funding will help the District offset the cost associated with an increasing student enrollment. The district is gained capped and the current school funding formula does not provide dollars for nearly 1,200 students. Additionally, this will help ensure the district makes the 2016 operating levy last longer than the 3 years promised at the time of its passage.”

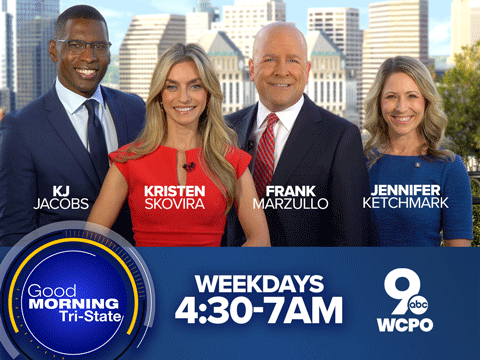

The Journal-News is a media partner of WCPO - 9 On Your Side.